Changes in incentive programs can have a radical impact on the industrial use of this fuel, just as the very mild winter season (heating season) can cause a drop in production and a reduction in consumption. These uncertainties have generated delays in the construction of new production sites in areas with high availability of feedstock.

- 0

- 2.1K

- 0 likes

Development perspectives for the pellet industry

Are these going to be hard times for pellet?

According to the latest “Pellet Market Overview 2019 - Preliminary Report”, published in November 2019 by the European Pellet Council, the demand for wood pellets worldwide is constantly growing, both in the industrial market and in the district heating market.

Demand grows faster than supply

North America

In North America, the increase in wood pellet production remained comparatively low in 2018 due to delays in planning new production plants and bad weather conditions (hurricane, forest fires, floods), that affected the overall production volume, which has increased by 200,000 tons (+ 8%). Canada still remains the third largest producer in the world, behind China and the EU-28.

Europe

Europe, which grew by over 9.2% overall, reached 20.1 million tons of pellet production in 2018, and continues to be the undisputed world leader.

Baltic States

The Baltic States are among the pioneers in the production of pellets, having started producing significant quantities of pellets as early as the 90s. Since then, pellet production has developed rapidly in the three Baltic States (Latvia, Estonia, Lithuania), although in 2018 there was a shortage of availability of raw materials.

The shortage began in 2017, when extreme weather conditions hampered forestry operations.

Because of this, prices have risen to a record high. The situation changed in 2019, a positive year from the point of view of the supply of raw materials. Forecasts indicate that the level of wood pellet production in the Baltic countries will increase slightly in the coming years. Few new production units will be put into operation, such as the one Stora Enso is currently building about 100 km east of Riga, at the LaunKalne sawmill.

In recent years, however, the consumption of fine wood pellets in the Baltic Sea region has started to grow rapidly, reaching around half a million tons per year. Local consumption of high-quality wood pellets is expected to continue to increase in the coming years.

Sweden and France

The sole exceptions are Sweden and France, which recorded the highest increase (in absolute terms) in the consumption of pellets as fuel for residential plants, but also for commercial ones.

France is likely to show even stronger growth in 2020, thanks to the continued sale of wood pellet appliances.

Russia

The production volume in Russia increased by 12% in 2018, bringing the total production to 1,600,000 tons. This is probably the consequence of the strong demand from Europe, and the subsidies for the export of this fuel, mainly addressed to Denmark, Belgium, Sweden, the United Kingdom and South Korea.

For the next 10 years, Russia expects an average annual growth rate of 10%. Being already among the top three ENplus pellet producing countries, it could become a world leader in the future.

Domestic consumption in Russia is still very low, around 10% of total production, because subsidies are lacking in many regions. Given the high transport costs to the rest of Europe, small producers obviously want to sell most of their production on the domestic market.

As soon as the storage points of combustible materials begin to professionalise the national market, ENplus certified wood pellets can become a required fuel in Russia too.

Despite this rather dynamic growth in supply, the demand for this fuel in Europe continues to grow faster than production.

In 2018, the demand for pellets in Europe increased by 2.1 million tons compared to 2017.

The increase was 8%, lower than the 2017’s increase of 11%, also because the heating seasons 2016- 2017 and 2017-2018 have been significantly colder than in previous years in most EU countries. In 2018, demand increased in the residential, commercial and industrial sectors, by approximately 5% and 13% respectively.

The lower growth in pellet consumption in 2018 compared to 2017, can be explained by the trend in sales of heating appliances in Europe, which have not experienced strong growth in this period.

Italy

Italy recorded a slight decrease of -4.5% in pellet consumption, but is still the largest consumer of residential pellets in Europe.

In recent years the winters in Italy have been hot and the autumns very cold, therefore the growth in the use of wood pellets has not been dynamic.

A series of policies focused on air quality and related media campaigns have contributed to reduce sales. This has influenced consumers and / or encouraged some producers to focus more on high quality products rather than on production

volumes.

A cold spring last year partially eased the negative winter season, but pellet consumption decreased slightly. So everyone is looking towards the next winter season which could represent a turning point in the market – positive or negative.

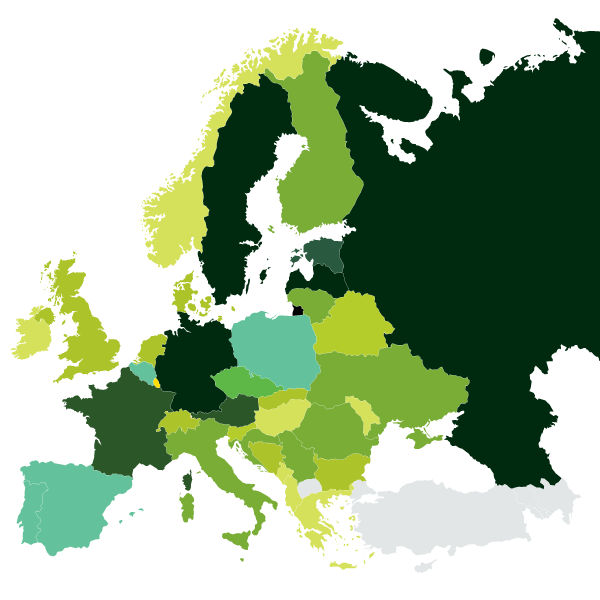

Figure 1. Pellet producers in Europe in 2018

Data in tonnes, source: EPC SURVEY 201920,3

European Production

million tons in 2018

16,9

PRODUCTION IN EU-28 COUNTRIES

million tons in 2018

![]() > 1,5 m

> 1,5 m

![]() > 1 m

> 1 m

![]() < 1 m

< 1 m

![]() > 600.000

> 600.000

![]() < 600.000

< 600.000

![]() > 100.000

> 100.000

Pellet production in 5 major European producing countries in 2018

- Mln ton

- Mln ton

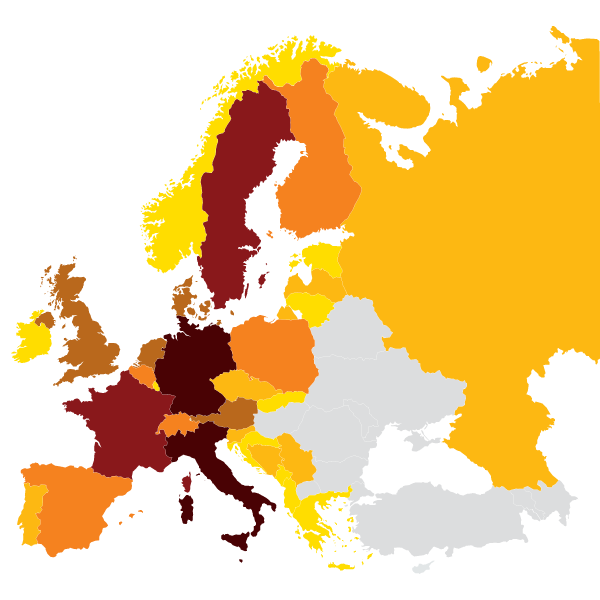

Figure 2. Consumption of wood pellets in EU-28 for heating in 2018

(Data in tonnes), source: EPC SURVEY 201916,7

European Consumption

million tons in 2018

15,7

Consumption in EU-28 countries

million tons in 2018

![]() > 2 m

> 2 m

![]() < 2 m

< 2 m

![]() > 1 m

> 1 m

![]() > 600.000

> 600.000

![]() > 300.000

> 300.000

![]() > 100.000

> 100.000

Consumption of pellets among the Top 5 of the EU in 2018

- House heating

- House heating

The ecological wareness of Europeans is growing

The demand for wood pellets in Europe and in the world is constantly growing. The environmental awareness of European society has also grown.

However, Europe is grappling with the problem of the availability of raw materials, which is also used, for example, to produce panels, or serves as fuel for the professional energy industry. It should also be added that smog pollution, which in recent years has become a problem for most European cities, is the reason for a change in the way of thinking of an increasing number of citizens. The mandatory replacement of boilers with upgraded ones, which are more efficient and constitute ecological heat devices, has contributed to a significant increase in demand.

In short, it should be remembered that sudden increases in consumption or an unexpectedly cold winter can lead to temporary fuel supply difficulties.

On the other hand, hot and long summers and mild winters can lead to a sudden market crash.

It is therefore necessary for the pellet industry to increase its flexibility and credibility. One way to do this is to standardize products with recognizable labels like ENplus, and possibly a national certification system.

It is also important to recognize the value of cooperation – the whole sector together – and to commit ourselves to producing quality wood pellets.

Consumption of pellets among the Top 5 of the EU in 2018

- Produttori pellet nel mondo

- Produttori pellet nel mondo